Contrary to popular belief, the market works! The trick is knowing how to win the game!

Here are some facts to consider:

Winning consistently in the Market takes several things; discipline, a solid investment strategy, access to historical performance, an understanding of asset allocation, dollar cost averaging, and then having the patience and the perspective to capitalize on the correct market opportunities. One of the biggest factors to finding and capitalizing on these opportunities continues to be who you hire to manage your money.

Sometimes the best way to learn something is to do it! Click on the icon above (How the Market Works) and play the stock market game without investing any of your hard-earned money.

The stock market is random and unpredictable. However, there are some who believe they can master anything, and to those of you who are wired this way, we have provided the following exercise or test below. The stock market is random…the following exercise or test below.

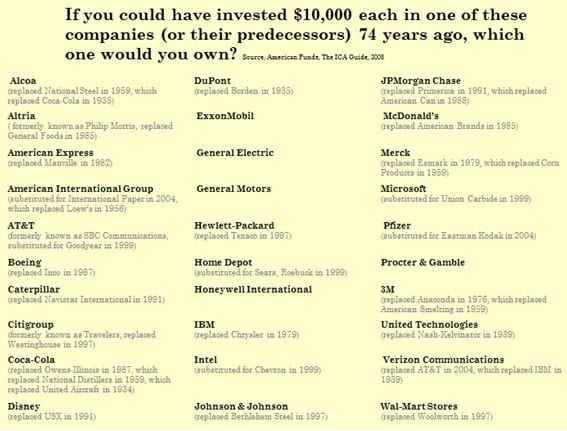

If you could have invested $10,000 in the stock market in 1933, and you could choose one of the companies listed here, which one would you choose?

They say hindsight is 20/20 so you are getting the benefit of knowing most of these companies and their track record over the past 85 years!

Your Financial Plan has multiple components, all of which are important for you to become financially self-reliant. Budgeting and Debt Elimination are the catalysts of any good financial plan. Emergency Savings together with long-term and short-term savings add fuel to the fire. Risk Management then helps to protect you and your assets/liabilities from unforeseen problems. This allows you to turn your liabilities into assets, giving you the ability to use the payment savings to grow your retirement nest egg.

While all of the things mentioned are important to building your Financial Map, the acquisition of life and disability insurance allows your dreams to be realized even if there is a future catastrophic event, that would otherwise have compromised your plans. It’s a balancing act, where each of the blocks you have carefully stacked could come toppling down without the support of the others. Ask an M3 Wealth Financial Cartographer or guide how to build a solid self-completing Financial Map!

Schedule and Complete your COMPLIMENTARY

“Retirement Planning Appointment”

and get… Patrick Kelly’s best-selling book;

Stress-Free Retirement as our FREE gift!